Top Surgery Insurance Guide

How to Get Your Gender-Affirming Surgery Covered

Navigating

insurance for gender-affirming top surgery can

be overwhelming. This guide walks you through

everything you need to know about getting your

private/employer insurance to cover your top

surgery.

Navigating

insurance for gender-affirming top surgery can

be overwhelming. This guide walks you through

everything you need to know about getting your

private/employer insurance to cover your top

surgery.

Note: If you have Medicaid or Medicare, coverage rules are different. While some states' Medicaid programs cover top surgery, others do not. Medicare generally covers top surgery but may have specific documentation requirements. Learn more about Medicaid and Medicare top surgery coverage.

1. Does My Insurance Cover Top Surgery?

After the Affordable Care Act (ACA) prohibited discrimination based on gender identity in 2016, many health insurance plans in the United States started covering gender-affirming procedures, including top surgery. Thanks to the ACA, insurance companies are no longer allowed to:

- Deny coverage because you're transgender or have a pre-existing condition like gender dysphoria.

- Cancel your plan if your medical needs change (such as coming out as transgender).

- Deny you the same benefits offered to others based on your gender identity.

These federal protections can support your case if you're facing coverage denials or discrimination.

However, insurance coverage for gender-affirming surgery varies greatly based on the insurance provider, plan, and state. For example, even if you have coverage for chest masculinization, you may find that your plan doesn’t cover liposuction, nipple grafting, or other aesthetic enhancements and revisions. Also, each insurance plan — even from the same health insurance company — can be different. It’s vital that you check your specific plan to find out if you can get your top surgery covered by insurance.

Some U.S. states now prohibit discrimination in health insurance based on gender identity. If you live in one of these states—such as California, New York, Illinois, or Oregon—your insurance company may be legally required to cover gender-affirming care. See a full list of states with trans-inclusive health coverage laws.

If you’re a student, don’t forget to check your school’s health insurance policy. Many colleges and universities now include top surgery coverage in their student plans, even in states without mandated protections. View a directory of student health plans with trans-inclusive coverage.

How to Confirm Coverage

You’ll need to confirm your coverage with both your health insurance company and your surgeon.

- Get the most up-to-date version of your plan's Certificate of Coverage and locate the exclusions and limitations section. Look for anything related to transgender, gender, sex change, etc.

- Contact your health plan directly

to verify coverage in your policy. Asking

specific questions will help you get

clear, accurate answers. Ask your

insurance representative:

- Is CPT code 19303 a covered service for diagnosis code F64.1 (gender dysphoria)?

- Is my surgeon in-network or out-of-network?

- How much will I pay for the deductible and coinsurance?

- What is the out-of-pocket maximum?

- If my insurance doesn’t pay the full amount for my surgery, do I have to pay the balance?

- Call your surgeon’s office to

verify that they are covered by your plan.

Also ask these questions:

- What CPT codes will you use?

- Will you submit the claim, or do I?

- What will I owe out-of-pocket?

- Are revisions covered if needed?

In-Network means that your insurance company has an established relationship with your surgeon and that most of your care will be covered. Your co-pays will likely be lower as well.

Out-of-Network means that your surgeon doesn’t have a relationship with your insurance company or your specific plan. Ask your insurance company if they provide out-of-network benefits and if authorizations or pre-approvals are required before you can receive care. Out-of-network care is usually reimbursed at a lower rate, meaning you may owe more out-of-pocket. If your preferred surgeon is out-of-network with your insurance, ask if they would be willing to work out a single-case agreement.

2. Understanding Medical Necessity

Insurance companies require documentation that indicates that top surgery is medically necessary for you. The medical necessity of gender-affirming surgeries is widely recognized by major medical organizations, including the American Medical Association (AMA), American Psychiatric Association (APA), and the World Professional Association for Transgender Health (WPATH). Citing these authorities can strengthen your insurance appeal if your procedure is denied.

Depending on your insurers’ requirements, you’ll need one or two letters of support from licensed mental health professionals that confirm:

- A diagnosis of gender dysphoria;

- Persistent gender incongruence; and

- A description of how the surgery will alleviate dysphoria.

To avoid delays or coverage denials, be sure to ask your letter-writer to use the exact language found in your insurer's medical policy.

3. Preauthorization and Approval

It’s essential to choose a surgeon who is experienced in gender-affirming care. Their office staff should include an insurance specialist who understands the requirements for coverage and can guide you through the process. This person will help you gather the necessary documentation (letters of support, a formal diagnosis, therapist notes) and submit a preauthorization request to your insurance provider. Approval typically takes between two and eight weeks.

The Gender Confirmation Center in San Francisco has an Insurance Advocacy Team. Their team lead, Jennifer, has managed to secure coverage for over 90% of their patients. Other practices with dedicated insurance specialists include:

- Align Surgical – San Francisco and Los Angeles, California

- Dr. Laurel Chandler – Darien, Connecticut

- Crane Center – Austin, Texas and San Francisco, California

If you’re working with an out-of-network surgeon and plan to seek reimbursement from your insurance provider, it’s important to know that reimbursement can hinge on billing practices, coding distinctions (cosmetic vs. reconstructive), and insurer discretion. Even with preauthorization, patients sometimes get billed huge sums of money after surgery. Your surgeon’s insurance concierge can help you understand what preauthorization actually guarantees and provide clarity about what your financial responsibilities will be and how your surgery will be coded and billed.

4. Denials and Appeals Process

Denials of coverage are common so don’t worry too much if you get a denial. If your request is denied, ask for a denial letter with a clear explanation, and find out when the appeal deadlines are. Next, ask your surgeon’s insurance specialist to help you file an appeal. Consider getting legal aid from LGBTQ+ organizations such as Lambda Legal, if needed.

Advocates 4 Trans Equality’s Trans Health Project has excellent information to help you understand the appeals process.

Submit documentation with your appeal that reinforces your case, such as statements from medical associations and journal citations.

Special note about nipple graft insurance denials: Unfortunately, the insurance companies Aetna and UnitedHealthCare view the nipple grafts procedure as cosmetic and regularly deny coverage for this aspect of top surgery. When this happens, the patient is required to self-pay for nipple grafts at the contracted rate that your insurance company would normally pay. This rate could be significantly higher than what you’d pay if you were self-paying for your top surgery. One way around this is to either opt out of nipples entirely or choose 3D nipple tattoos instead.

5. How to Get Reimbursement

Many patients pay out-of-pocket for surgery and then seek reimbursement from their insurance provider—especially when working with an out-of-network surgeon. If your surgeon is out-of-network, ask them for a “superbill” after your surgery. A superbill is a detailed document prepared by your surgeon’s office that lists:

- Services performed (with CPT codes)

- Diagnosis codes (ICD-10)

- Dates of service

- Provider information

- Total charges

You can then submit the superbill to your insurance company, which may reimburse you a portion of the cost, based on your out-of-network benefits. Watch out for facility, anesthesia, or pathology charges not covered by insurance as these can add up.

Be persistent and proactive. Insurance coverage for top surgery is improving, but the process still requires self-advocacy, paperwork, and sometimes appeals. Knowing your rights and being prepared can help you get the care—and the insurance coverage—you need.

Resources

- Top Surgery Insurance Checklist

- More Insurance Tips

- Insurance Companies That Cover Gender-Affirming Care

- Glossary of Insurance Terms

- Trans Health Insurance Guides: If you’re shopping for health insurance, Out2Enroll.org can help you understand your options. You can also make an appointment with an LGBTQ-affirming enrollment assistant who can help you enroll for free.

Appendix: CPT and ICD-10 Codes for Billing

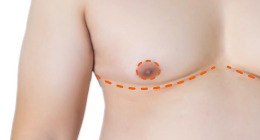

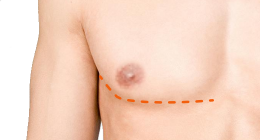

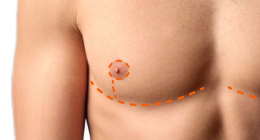

FTM/N Top Surgery (Chest Masculinization):

- 19303-50-22 (simple mastectomy). This code describes a bilateral simple mastectomy with increased procedural complexity. The base code, 19303, refers to a simple or complete mastectomy and is commonly used for top surgery, particularly the double incision technique. The -50 modifier indicates that the procedure was performed on both breasts, while the -22 modifier signifies that the surgery required significantly more time, effort, or complexity than usual.

- 19318 (reduction). The code for reduction mammaplasty is sometimes used for top surgery, depending on the technique performed (usually periareolar or keyhole, or double incision with minimal skin removal where the procedure resembles a breast reduction more than a full mastectomy), the surgeon’s coding practices, and how the procedure is framed to the insurer (reconstructive vs. cosmetic). It might also be used if the insurance company has better coverage for 19318 than mastectomy codes like 19303, or if a case is being made for functional impairment (e.g., back pain, skin irritation) in addition to gender dysphoria.

- 19350 (nipple graft). In gender-affirming surgery, this code is frequently applied to describe free nipple grafting performed during double incision top surgery. This procedure is reimbursable when properly documented as part of medically necessary gender-affirming care.

- 15200 (nipple-areola complex removal and relocation). This code is typically used for procedures involving full-thickness skin grafts, which can include nipple-areola complex (NAC) repositioning or relocation. However, it is less commonly used in gender-affirming surgeries. The code describes the grafting of skin generally, rather than procedures specific to the NAC. While CPT 15200 may be reimbursable, it is often considered cosmetic unless clearly justified as medically necessary. It is not typically used for standard top surgery billing unless the procedure involves a more complex NAC relocation that doesn’t require full removal and regrafting.

Diagnosis Code:

- ICD-10: F64.1 (gender dysphoria)

Note: Specific coding may vary by insurer and surgeon.

Last updated: 05/26/25